In this episode of the Compassionate Capitalist Show, Karen engages in an enlightening conversation with Brett Martin, a seasoned serial entrepreneur, angel investor, venture capitalist, and visionary. Brett shares his remarkable experiences and profound insights, offering listeners a glimpse into the world of entrepreneurship and venture investing. Here are four key takeaways from the episode:

1. Entrepreneurship- Nature vs. Nurture: The discussion delves into the age-old debate of whether entrepreneurs are born or made. Brett shares his personal journey, starting with his entrepreneur journey ‘selling seashells at the seashore’ to becoming a venture capitalist, highlighting the combination of inherent passion and cultivated desire to venture into the exhilarating world of startups.

2. Becoming a Angel Investor: Brett reveals the pivotal moment when he transitioned to the investor side of the table, exploring different avenues such as solo angel investing, angel networks, and eventually co-founding Charge Ventures, a pre-seed-focused venture fund. He sheds light on the inherent risks and wealth-building potential associated with investing in successful entrepreneurial endeavors.

3. The Compassionate Capitalist System: Brett emphasizes the significance of compounding impact and return on investment by investing in multiple successful companies. He discusses his shared mission with Karen to educate investors, aiming to create a profound positive influence on the world while generating substantial wealth.

4. Charge Ventures: Brett provides insights into the foundation and philosophy of Charge Ventures, a seed and pre-seed venture firm. He explains their focus on partnering with passionate founders building innovative products and services that tackle future problems. The episode highlights a few portfolio companies like ADAPT, ARA, Bedrock, and Bison Trails, showcasing the diverse industries addressed by Charge Ventures.

5. Future of Work: Innovative way to create community and connection in our new way of work that most often involves remote teams working together, often in isolation.

Brett Martin is President & Co-Founder of Kumospace, the virtual office platform where teams show up, as well as Co-Founder & Managing Partner of Charge Ventures, a pre-seed-focused venture fund based in Brooklyn, NY. He also serves as an Adjunct Professor at Columbia Business School, where he teaches data analytics and technology strategy.

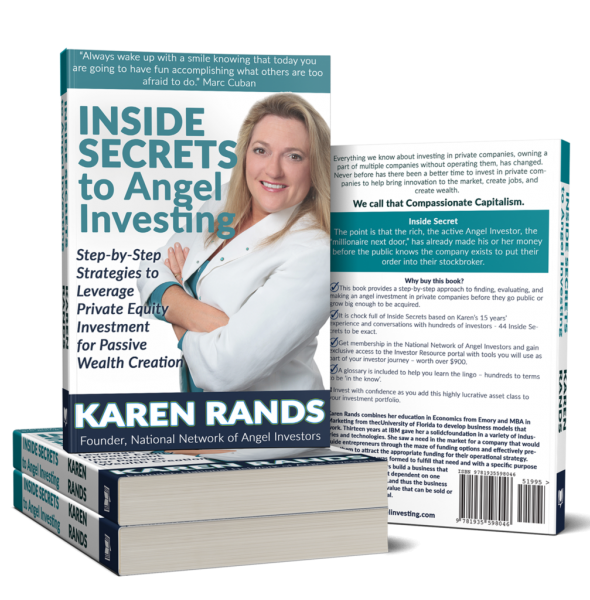

Visit http://kumospace.com and set up your free trial. If you are interested in getting started with seed stage venture investing (after reading Karen’s book Inside Secrets to Angel Investing of course) connect with Brett on Linkedin and check out https://charge.vc/

besides their portfolio, you will find a blog under writings that has thoughtful and well developed articles on tech trends, and resource site for startups with terms and best practices.

Karen Rands is the leader of the Compassionate Capitalist Movement and author of the best selling investment primer: Inside Secrets to Angel Investing: Step-by-Step Strategies to Leverage Private Equity Investment for Passive Wealth Creation. She is an authority on creating wealth through investing and building successful businesses that can scale and exit rich. Karen is an enthusiastic speaker on these[…]