Today on the Compassionate Capitalist Show, we are diving deep into the fascinating world of artificial intelligence and its transformative impact on businesses and investment strategies. David Marra, a trailblazer in quantitative asset management and financial innovation, joins host Karen Rands to discuss how AI has evolved to simplify implementation for businesses and its profound potential to drive global growth.

In this episode, David Marra shares his expertise on managing investment portfolios using AI, the importance of diversification, and strategies to minimize risk while maximizing returns. Karen and David explore topics such as the state of the technology market, the role of private equity, and the need for balancing portfolios to weather market volatility.

Key Take Aways:

1. The Evolution and Impact of AI on Businesses

+ With a look at tech impact since the Industrial Revolution

+ The potential for AI to drive growth rates globally

+ Application of AI in logistics, customer service, and sales.

2. Risk Management and Portfolio Diversification

+ AI isn’t a sector so not a bubble, it is fuel for innovation

+ The need to decorrelate risk and minimize exposure to large losses.

+ Weathering market storms through diversified investment strategies.

3. AI Stocks and Investment Strategies

+ Financial advisor recommendations on portfolio allocation in private equity or angel investments.

+ Balancing private equity with income-producing assets.

+ Diversification principles applicable to angel investments as well.

4. Managing Risk for Long-Term Income

+ Impact of market crashes and recovery periods.

+ Importance of risk management and capital protection for consistent income.

+ Importance of long-term thinking for solid fundamentals and

Holding onto good investments amidst volatility.

Whether you’re an investor seeking to mitigate risk, an entrepreneur looking to leverage AI, or simply curious about the future of financial markets, this episode is packed with valuable insights to help you navigate the ever-evolving landscape. Tune in as Karen Rands and David Marra explore the power of AI in investment strategies and its broader implications for business growth. Don’t miss out on this riveting conversation. Listen on your favorite podcast platform or youtube (https://youtu.be/pWW-wcS8-sg)

David Marra is a distinguished quantitative investment manager who skillfully merges the principles of economics with advanced statistical learning. He is a proud graduate of the University of Chicago’s business school, a prestigious institution renowned for its Nobel laureates and contributions to economic theory. David leverages his extensive education in finance to approach investing with a blend of empirical and theoretical knowledge, drawing from the rich history of economic thought from Adam Smith to modern-day advancements. His unique approach also incorporates cutting-edge techniques from statistical learning, emphasizing the use of large datasets and computational power.

Learn More at: Markinfunds.com

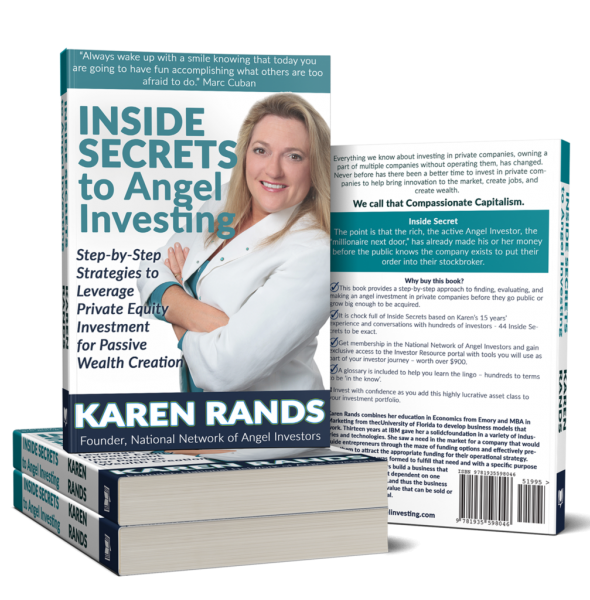

Karen Rands is a best selling author, top rated podcaster, and sought after advisor for founders and investors. Learn more at her website:

http://kugarand.com

[…]