Join us in this episode as we explore the world of Opportunity Zones. Landon Johnson, of CapZone Analytics, joins Karen Rands to dive into the latest IRS regulation changes impacting Qualified Opportunity Zone Funds (QOZFs) and unravel the complexities surrounding compliance. Whether you’re new to this concept or already involved as a fund participant, investor, or fund manager and developer, compliance is where the rubber meets the road to ensure you maximize the benefits of investing in Qualified Opportunity Zone Funds.

Karen kicks of the discussion with a brief history behind the bipartisan effort in Congress to be a catalyst for change by providing strong financial incentives for investors to seek investment opportunities in underserved rural and urban communities. The impact and benefit has been siezmic. Since it’s passage as part of the Tax Code changes in 2017, there are more than 8,768 designated Qualified Opportunity Zones in the 50 states, and five U.S. territories, including American Samoa, Guam, Northern Mariana Islands, Puerto Rico, and the Virgin Islands. Total QOZF equity investments had reached $48 billion by the end of 2020, with 48% of those communities benefiting from projects and investments underway, according to the Economic Innovation Institute, compared to the 18 years it took for the SBA backed Venture Capital program, New Market Tax Credits, to reach the same level. The economic ripple effect of QOZF felt beyond the targeted areas is clearly evident as well, because the projects are more than affordable housing, they also involve the building of commerce centers, manufacturing and distribution facilities, and modernization and expansion of aging businesses.

Landon sheds light on the nuances of the Opportunity Zone Fund tax codes, including deferral and reduction of capital gains, tax offsets based on investment length, and the differences between real estate development and operating business acquisitions. He shares valuable insight on what red flags to watch out for, and offers a solution to ensure you reap the rewards without facing hefty penalties.

Join Karen and Landon as they explore the transformative impact of Opportunity Zones and how to navigate compliance effectively.

Key Takeaways:

1. Identify compliance issues early to protect your investment and avoid legal and financial penalties.

2. Prioritize investment-grade due diligence and compliance when raising funds to mitigate future risks.

3. CapZone Analytics offers a groundbreaking platform that analyzes OZ compliance data, identifies gaps and risks, and establishes a solid compliance posture.

4. Stay informed about proposed legislation and potential extensions to the Opportunity Zone program, as they can significantly impact your investment strategy.

5. Gain a competitive edge by understanding the shifting landscape of tax codes and implementing intelligent compliance strategies.

Guest: Landon Johnson, Chief Marketing Officer at CapZone Analytics, brings extensive experience in optimizing marketing, sales, and go-to-market operations for hypergrowth technology companies. As a passionate change agent focused on driving innovative business strategies and process improvements from ideation to implementation, Landon has served as a leader, consultant, and advisor to over 100 companies throughout his 25 year career. His experience navigating[…]

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but other than that this is fantastic blog A great read Ill certainly be back

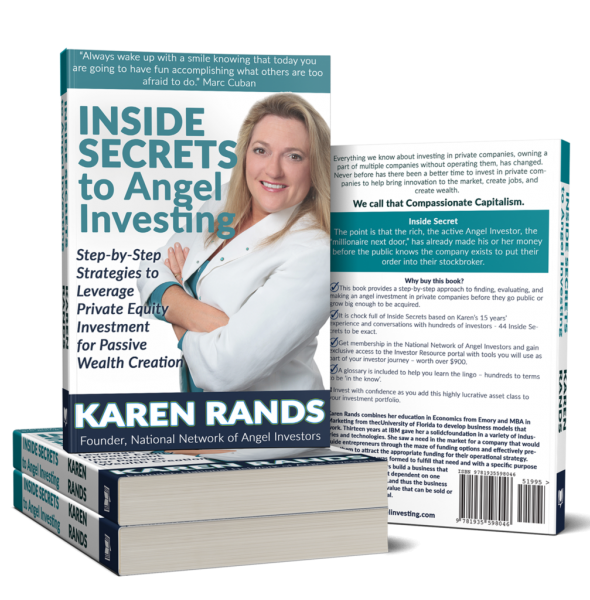

Thank you for your response. Yes I did write a book — you can learn more at http://insidesecretstoangelinvesting.com AND you can get the book digital plus all the resources and LEARN about investing in entrepreneurs at http://dothedeal.org.

I do believe all the ideas youve presented for your post They are really convincing and will certainly work Nonetheless the posts are too short for novices May just you please lengthen them a little from subsequent time Thanks for the post

Thank you for your feedback. The good news is we have an email newsletter that expands on all of these concepts. Sign up on the contact page.

To learn more about angel investing go to http://dothedealorg