Yaniv Sneor, co-founder of the Mid Atlantic Bio Angels (MABA), a life science angel investor group, joins Karen Rands on The Compassionate Capitalist Show to discuss the purpose and process of the investor network. The life cycle and milestones used to measure progress and assess risk of Life Sciences companies as an early stage, pre-revenue company, are different than tech or consumer product companies. Often there isn’t a tangible MVP (Minimum Viable Product), a prototype, or a beta to validate that the innovation works. Yet MABA seems to have broken the code and figured out how to evaluate, invest, and create a return on investment in the biomed, med tech, life sciences segment. Investors committed to bringing bio and medical innovations to the market are the minority in the broad scope of angel investors and angel investor groups. Learning from those investors that have figured out how to invest wisely and profiably in this complex sector is incredibly valuable.

Yaniv and Karen talk about:

- Key Milestones to consider that reduce inherent risk

- Importance of getting to exit without VC money

- How MABA offers Direct Investment and SideCar “Index” Fund

Yaniv has held every C-level position and led his companies through merger, acquisition, capitalization, and turnaround leadership with companies ranging from start-up to growth stage. Mr. Sneor is also currently the CEO of Native State Therapeutics, an early state biotechnology company in the neurodegeneration field. More information: MABA Members http://bioangels.net and their co-investment Sidecar Fund https://sidecarfund.bioangels.net/ , for non MABA member investors

Video versionof this episode: https://youtu.be/hsKWwjuLsQY

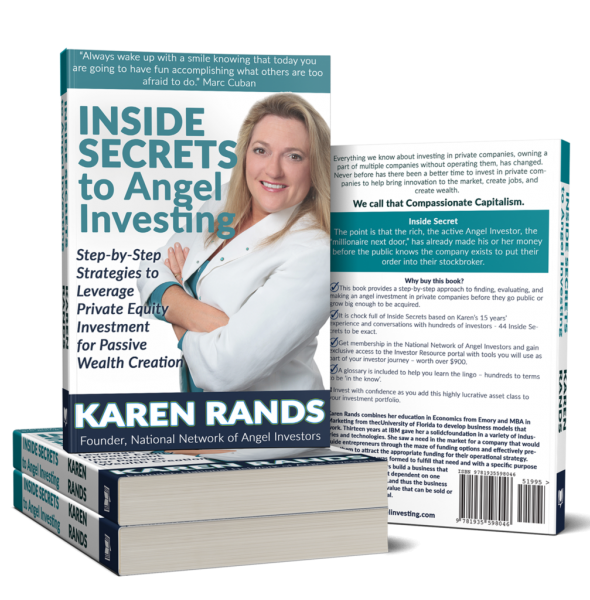

Educated as an economist, Karen Rands is leading the Compassionate Capitalist Movement and author of the best selling Inside Secrets to Angel Investing. http:/InsideSecretstoAngelInvesting.com

Karen Rands, is the leader of the Compassionate Capitalist Movement™ and author of the best selling financial investment primer: Inside Secrets to Angel Investing: Step-by-Step Strategies to Leverage Private Equity Investment for Passive Wealth Creation.

Did you know that the ‘idea of’ and the ‘how to’ create wealth as accredited angel investors by investing in entrepreneurs and owning a piece of multiple private companies was a secret for non-millionaires for over 90 years. Karen is an authority on creating wealth through investing and building successful businesses that can scale and exit rich. This podcast is the infomercial for the idea of angel / crowdfund investors as Compassionate Capitalists.

The Compassionate Capitalist Wealth Maximizer System is now available for those investors that want to learn how to invest in entrepreneurs as an asset class like real estate or the stock market. Visit http://Kugarand.com to get your free gift: 12 Inside Secrets to Innovation and Wealth and join the email wait list for the next Free Intro – Wealth Mastery Immersion Challenge

Already investing? Learn how to hire Kugarand Capital Holdings to identify the red flags of deal before you invest, or find out hwo to help syndicate your capital raise.

Other Links: Book, Social Media, Other[…]