Today, we have an exciting and enlightening conversation with Rick Jordan, a cybersecurity expert, bestselling author, and host of the “All In with Rick Jordan” podcast. In this episode, we delve into the intricacies of raising capital through Regulation A (Reg A+) and the strategic process that sets companies up for success.

Karen and Rick explore how Reg A+ can create momentum and garner investor trust even before a company goes public, serving as a fascinating alternative to traditional fundraising methods. Rick shares his own journey, from leveraging relationships built at Geek Squad to establishing his company ReachOut in 2010, and how he navigated the challenges and opportunities of Reg A+.

They discuss the importance of documentation, the shift from transactional to relational business approaches, and the critical role of audits in building credibility. Along the way, Rick recounts his personal entrepreneurial journey, the impactful lessons learned from early side hustles, and emphasizes the power of taking action, even when the path isn’t perfectly clear.

Listen as Karen and Rick explore the blend of passion, purpose, and strategic insight necessary for entrepreneurial success, and discover the intriguing world of Reg A+ fundraising from an insider’s perspective. It’s an episode filled with valuable lessons and real-world advice you won’t want to miss

Key takeaways in this episode

-

Regulation A (Reg A) Process

– Benefits of Reg A vs. traditional funding (angel investors, venture capitalists)

– Raising momentum and awareness before going public

– Importance of solid documentation for investor decisions

– Establishing marketplace credibility (pink sheets or OTCB)

– Credibility with investors through financial statement audits provides third-party validation

2. Strategic Market Building

– Avoiding “dog and pony” shows

– Genuine market interest and trading activity

– Attraction of significant investment (pipe money)

– Essence of sales in understanding and solving customer problems

3. Reg A+ as an Iterative Fundraising Strategy

– Incrementally raising funds (rounds) to increase company value

– A way for Angel Backed companies to raise capital when Angels, VCs, and PEs say NO and Banks won’t loan enough

– A Strategic way to avoid excessive early equity giveaways

– Strategic adaptation and increased valuation through acquisition

– Challenges in Reg A+

– Marketing and market creation costs

– Reliance on accredited investors and institutional investors to reach capital goals

4. Original Intent of Reg A+

– Provision from the 2012 JOBS Act to make onramp to IPO easier – Democratizing investment in prio IPO companies

– Accredited vs. Retail Investors

– Primary targets for significant investments

– Raising money from retail and institutional investors

– Market Enthusiasts and Penny Stocks with Karen’s personal anecdote about the allure of penny stocks

– Using Reg A Plus to list on OTC market

5. Rick Jordan’s Entrepreneurial Journey

– Impact of focusing energy on projects

– Importance of going “all in” for growth

– The allure of multiple side hustles and the importance of full commitment

– The journey of entrepreneurship compared to climbing Mount Everest

– Importance of passion, purpose, and value creation in entrepreneurship

– Positive mindset and avoiding distractions (“weeds”)

– Starting ReachOut in 2010

– Transitioning from direct client relationships to scalable business

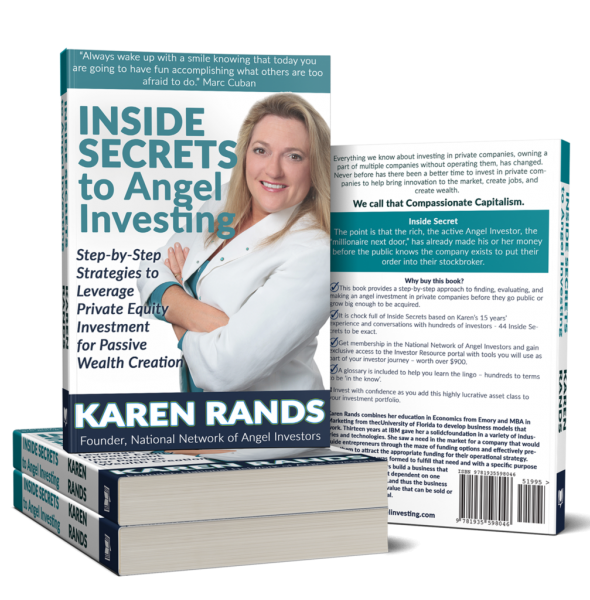

6 Compassionate Capitalism

– Investing in ventures aligning with personal passions

– Positive societal[…]