In this insightful episode, Karen is joined by thought leader and prolific angel investor David Mandel. David, known for his expertise in finance, insurance, advanced mathematics, and computer science, pivots into the world of venture investing after successfully exiting multiple traditional businesses. Since 2014, he has dedicated himself fully to the tech startup ecosystem, investing in over 500 startups and focusing on innovations in insurance-tech and fintech, as well as AI.

David and Karen dive deep into the intricacies of late seed stage investments, safe notes, and the market disruptions they’re causing. Alongside the excitement, David shares his mixed feelings about the future of AI balancing enthusiasm for technological advancements with concerns over rapid automation and its impact on future job markets. They also explore the incremental yet transformative progress in AI and its various applications across industries like legal tech and autonomous vehicles.

Join us as we uncover the challenges and opportunities in venture investing, the impact of AI, and the evolving landscape of technology and startups. This episode is a treasure trove of insights for seasoned and aspiring angel investors alike.

Key topics and take-aways:

> David Mandel’s Investment Journey

– Starting with angel investing as competitive advantage in business and expanding into venture capital:

– Moved from individual investing to pooled funds for credibility. Formed Emerging Ventures fund in 2019.

> Investment Philosophy and Strategy

– Focus on B2B technology sectors, avoiding consumer and life sciences.

– Emphasis on investing in startups with traction.

> The Role of AI and Automation

– Mandel’s interest in AI and its business applications:

– Generative AIs progress and impact on creative fields.

– Legal tech AI applications and implications for billable hours.

> Future Outlook and Concerns with the Adoption of AI

– Uncertain future and potential utopian vs. dystopian outcomes.

– Concerns over education and automation’s future impact on job markets.

– Attention to critical thinking skills and the generational understanding of technology.

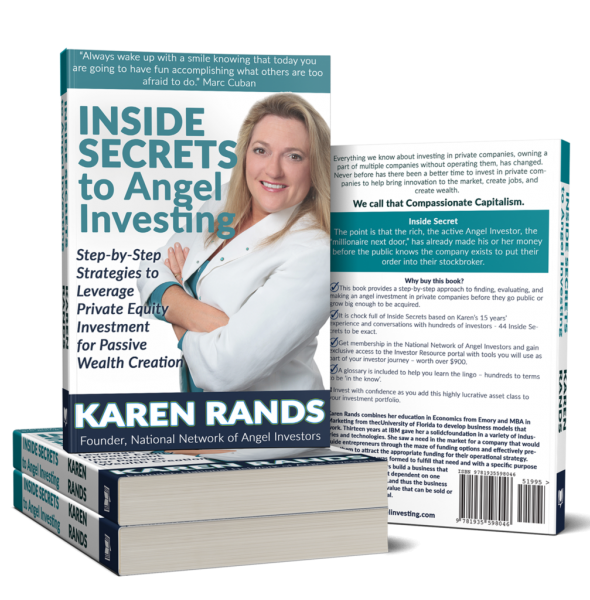

> Compassionate Capitalism and Funding Ecosystem

– Karen Rands’ advocacy for “compassionate capitalism”:

– Investing in solving problems with profit.

– Alternative funding options:

– Reg A Plus and direct public offerings as additional funding strategies.

– Traditional venture capital portfolio model:

– Probability of startup success and failure within a 10-investment portfolio.

> Advice for Startups and Investors

– Importance of startup timing and market entry.

– Encouraging early-stage investments despite perceived funding scarcity.

– The cyclical nature of venture capital and implications for new startups.

> Conclusion

– Importance of traction and market adoption as key indicators for investments.

– Recalibrating investment expectations in an evolving market landscape.

– Final notes on the role of good execution in startup success.

For more information and to connect with David Mandel, visit

Karen is the President of Kugarand Capital Holdings where her extended team offers coaching and services to small business owners providing capital strategy and investor acquisition through the Launch Funding Network. As a thought leader in Angel and Crowdfund Investing, Karen offers investors decision tools, education, screening, due diligence, and syndication services through the National Network of Angel Investors. More information can be found at http://karenrands.co And[…]