Whether you’re a founder, investor, or just curious about the startup ecosystem, this conversation is packed with actionable advice and behind-the-scenes insights.

Listen (or watch) as Karen Rands sits down withEric Fiegoli, co-founder of Exbo Group, to explore the world of startup finance, capital strategies for growth stage companies, and the evolving VC and Private Equity landscape. Karen and Eric discuss the intricacies of investing across the business lifecycle. From seed-stage startups to mid-cap companies, Karen explains how funding strategies differ and highlights opportunities for investors to share in the success of companies as they grow from startup to primed for an exit.

Since its inception, Exbo Group has grown from a two-person team to a thriving firm of 50 professionals, helping over 50 companies with fundraising, scaling, and refining their financial strategies. In this episode, Eric shares lessons from building a bootstrapped business, insights into fundraising strategies, and how Exbo Group maintains top-notch service quality even as it scales.

Key Takeaways

-

Insights into the current VC landscape for startups and key trends founders should watch. Additionally, insights into private equity and its role in business growth, and the importance of tailoring financial operations to meet growth-stage company needs.

-

Balancing growth and profitability, and available capital to grow a business through high growth stages. Key differences between seed-stage startups and mid-cap companies in fundraising.

-

Differences in investor priorities between today's fundraising climate and two years ago, and the Criteria investors use when evaluating mid-cap companies.

-

Challenges faced by businesses that are too large for seed funding but too small for private equity.

-

The role of specialized expertise in M&A and leveraged buyouts, and investment opportunities available when targeting companies with $5M to $75M in revenue.

-

The importance of understanding the life cycle of businesses for investment strategies, and how different stages of business attract distinct pools of capital.

-

Practical advice for founders tackling Series A and seed-stage fundraising, and Strategies for angel investors to engage in Reg A+ offerings.

-

Eric’s founder story: Challenges of bootstrapping a company and scaling from 2 to 50 employees in 6 years. Lessons learned from building a cross-functional team with diverse expertise. How Exbo Group supports businesses with finance, operations, and strategy services.

Guest Bio:Eric Fiegoli is the co-founder of Exbo Group, a leading finance, operations, and strategy advisory firm for growth-stage businesses. With a background spanning Deutsche Bank, TD Securities, and Amazon, Eric brings a wealth of experience in credit risk, debt markets, and product management. He has supported over 50 companies across industries such as software, healthcare, and edtech. Outside of work, Eric enjoys running, skiing, and spending time with his family.

Learn more about Exbo Group:https://www.exbogroup.com/

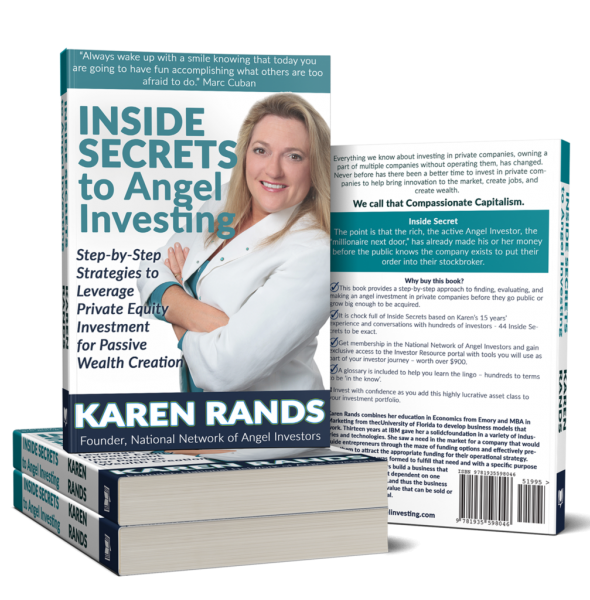

Karen Rands, author ofInside Secrets to Angel Investing and host ofThe Compassionate Capitalist Show. She is a thought leader in angel investing, leveraging decades of experience to empower entrepreneurs and investors to build wealth, as part of the Compassionate Capitalist Movement™. Check out the bookhttp://InsideSecretsToAngelInvesting.com

Learn More and get the free ebook – 12 Secrets to Wealth Creation and Innovation when[…]