Before the rules of REG CF were released, many companies would say they were raising capital through ‘crowdfunding’. Often they were not doing under the proper regulations offered through the JOBS Act or the SEC or their own state’s securities regulations. And, as capital formation methods of REG A+ become more popular, companies may cut corners in what they say and do, without having the proper paperwork in place. This puts investors’ capital at risk. There could be legal and financial repercussions when a company ‘says’ they are crowdfunding their capital raise but they aren’t doing it within the regulations. Inside Secret #43 addresses this and in this video/podcast, Karen explains it in more detail.

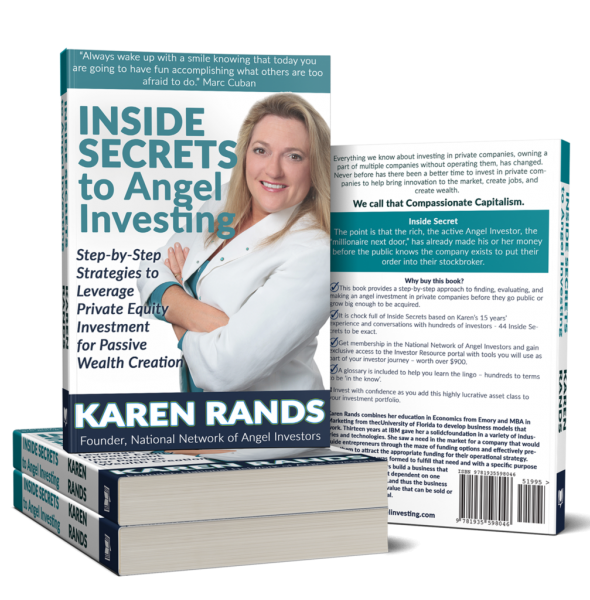

As 12th and final inside look explanation of a few of the 44 secrets Karen hared shared in her best selling financial how-to book for those savvy investors that want to get started or get better at investing in entrepreneurs: Inside Secrets to Angel Investing – Step-by-Step Strategies to Leverage Private Equity Investment for Passive Wealth Creation.

Buy the book: http://bit.ly/AngelInsideSecrets and get access to the Investor Resource Portal with documents and tools valued at well over $2000, and entry level membership in National Network of Angel Investors.

Get the 12 Inside Secrets Excerpt eBook Free: http://InsideSecretstoAngelInvesting.com

To learn more about how Karen helps investors master the art of investing in entrepreneurs visit http://karenrands.co/blog

Please subscribe to the Compassionate Capitalist Show wherever you listen to podcasts. Share with colleagues and friends and provide a positive review if you have enjoyed this series.

Available as video: https://youtu.be/wqQhpACAVfg