The Legalization of Equity Crowd Funding was the catalyst for the great Economic Democratization of the Capital Markets.

Although crowdfunding started with reward based, the advent of the JOBS Act in 2012 introduced 4 ways to raise equity capital from the crowd. The expanded pool of additional investors are not your typical angel investors. These 4 methods remove the invisible wall between entrepreneurs and their potential investors. There is still great confusion on how to best use equity crowdfunding to raise capital, and even more so, how traditional retail stock investors can get involved in a low risk way and start investing in the entrepreneurs with ‘unicorn potential’ or the small business owners that are well established and are seeking an amount of growth capital that is not available from their bank and they don’t fit a Venture Capitalist or Private Equity Fund criteria. They can be as solid of an investment as a retail stock, but with much greater upside potential. The 4 methods to solicit from the general public, to crowd fund, are not created equal. Each has it’s unique benefits to entrepreneurs and investors.

Watch and Listen as Karen explains the difference in the 4 equity Crowd Funding, Direct Public Offering methods: Intrastate Exemption (Reg D 504), Reg D 506c, Reg CF and Reg A+.

Watch on YOUTUBE: https://youtu.be/O_M27XJDIbY

Then take the next step and join Karen Rands’ Compassionate Capital Community: Sign up for the Video Tips on Best Practices for Creating Wealth with Successful Entrepreneurs: http://bit.ly/CCCB-signup Get the ebook – 12 Secrets to Creating Wealth Investing In Entrepreneurs: http://bit.ly/Get12SecretsEbook Get the #1 Primer on Learning to Invest in Entrepreneurs: http://InsideSecretstoAngelInvesting.com

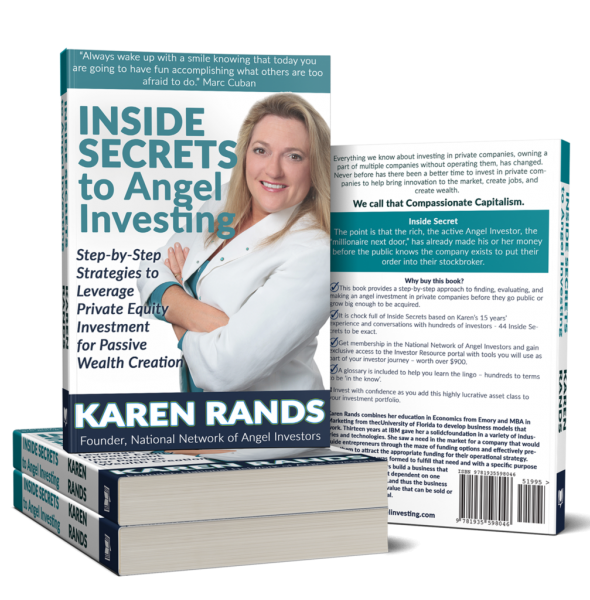

Karen Rands, is the leader of the Compassionate Capitalist Movement™ and author of the best selling financial investment primer: Inside Secrets to Angel Investing: Step-by-Step Strategies to Leverage Private Equity Investment for Passive Wealth Creation.

Did you know that the ‘idea of’ and the ‘how to’ create wealth as accredited angel investors by investing in entrepreneurs and owning a piece of multiple private companies was a secret for non-millionaires for over 90 years. Karen is an authority on creating wealth through investing and building successful businesses that can scale and exit rich. This podcast is the infomercial for the idea of angel / crowdfund investors as Compassionate Capitalists.

The Compassionate Capitalist Wealth Maximizer System is now available for those investors that want to learn how to invest in entrepreneurs as an asset class like real estate or the stock market. Visit http://Kugarand.com to get your free gift: 12 Inside Secrets to Innovation and Wealth and join the email wait list for the next Free Intro – Wealth Mastery Immersion Challenge

Already investing? Learn how to hire Kugarand Capital Holdings to identify the red flags of deal before you[…]