In this episode of the Compassionate Capitalist Show brought back to life from the vault, Karen Rands engages in a compelling conversation with Rashaun Williams, a late-stage angel investor and venture capitalist. Williams shares his journey from investment banking to venture capital, highlighting the unique approach he takes in late-stage private investments for predictable returns. The discussion provides valuable insights for new investors looking to navigate the startup landscape and collaborate with companies that offer resources for successful scaling and exits.

Key Takeaways:

1. Late Stage Investment Strategy: Williams emphasizes the importance of late-stage investing as a strategy for more predictable returns. He reveals the evolution of the late-stage industry, driven by companies staying private for extended periods, creating opportunities for investors to enter one to three years before the companies go public.

2. Accessing Top Deals: Williams shares valuable advice for new investors, suggesting involvement in accelerators and incubators as a means to access promising early-stage companies. He also highlights the significance of discerning the credibility of the deal sources and ensuring alignment with investors who have a track record of success.

3. Diversification and Portfolio Theory: The episode explores Williams’ strategic approach to diversification, not only by industry but also by stage, liquidity, and cash flow. By understanding the portfolio theory in venture capital and angel investing, Williams provides a roadmap for building a diversified portfolio with a mix of early-stage, growth-stage, and late-stage investments.

4. Angel Investing Defense: Williams offers practical tips for investors to safeguard their interests by asking critical questions before engaging in deals. He advises ensuring that deal sources have a vested interest, have conducted due diligence, and possess a proven track record in the specific type of deals.

Listeners can gain valuable insights into late-stage investing, portfolio management, and effective strategies for navigating the dynamic world of angel investing.

Rashaun Williams is a Sum Cum Laude graduate of Morehouse College in Atlanta, GA. As a former investment banker, turned venture capitalist, he focuses investments on tech, consumer products, and media companies. With over 100 investments under his belt, and over 20 exits, he has an impressive track record of picking winners. He invested in companies like Coinbase, Casper, Ring, PillPack, Lyft, and Dropbox. Over the last 15 years, he’s been primarily responsible for bringing capital to emerging, diverse, and alternative markets while working at Wall Street firms such as Goldman Sachs, Wachovia Securities, and Deutsche Bank. Currently Mr. Williams is a general partner at MVP All Star Fund, which is a late stage tech fund. Previously, he founded a venture capital fund, Queensbridge Venture Partners. For more information visit: https://www.mvp.vc/

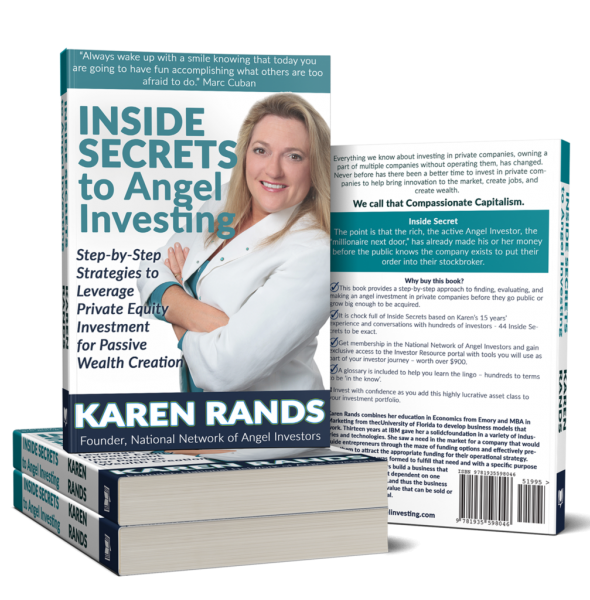

Karen’s call to action:

Imagine the feeling of investing in a way that had massive impact and a potential pay you back 10x your money. The time is now to find out if Angel Investing / CrowdFunding Investing is the wealth creation strategy for you. Take action on Karen’s offer to learn how to invest with confidence in entrepreneurs and sign up (FREE[…]