In this episode of the Compassionate Capitalist Show, Karen brings back a fan favorite from the vault to explain something she references often — Hall Martin’s strategy to It is a strategy he used to share the risk between angel investors and founders. This is where the term you hear Karen use: Payroll Exits – comes from.

Their discussion will span from the foundational principles of “compassionate capitalism” to the meticulous art of informed angel investing. Hall will unravel the critical factors for successful angel investments and offer gems on how angel investors can generate evergreen funds through savvy reinvestments.

Moreover, Hall will tackle the all-too-common scenario where startup founders start to seek to grow their compensation even as they miss their growth targets. Founders start to pay themselves more: payroll exits, while the investors internal rate of return declines the longer it takes the company to achieve a financial / sales level to sell the company for an equity exit. This 3x in 3 years is a practical approach to sharing that risk and fundamentally structured like a conversion note with a redemption right in the third year.

Key Take Aways:

### Term Sheet and Investor Relations

- Encouragement for angel investors to create their own terms

- Qualifying startups based on their exit intentions

- Rights for investors to exit after three years

### Understanding Investment Outcomes

- Identifying winners, losers, and lifestyle businesses

- Impact of payroll exits on investment return

- Differences between ROI and IRR

### Risk Assessment, Valuations and Exit Strategies

- Understanding the risks and potential exit strategies before investing

- Defining risks and clarifying expectations with entrepreneurs

- Recognizing realistic valuations and exit possibilities

- Avoiding investments in overvalued companies without clear exit strategies

So sharpen your pencils and get your spreadsheets ready as we explore how to mitigate risks, gauge entrepreneur commitment, and understand the nuances of venture viability. Whether you’re an entrepreneur searching for that initial investment spark or an investor keen on maximizing returns – this episode promises a wealth of knowledge with both Hall Martin and Karen Rands sharing their experiences.

Hall Martin, an indomitable force in the investment world, boasts a distinguished track record of empowering startups and fueling innovation. With over two decades of investment experience, Hall has facilitated the raising of more than $900 million for entrepreneurs through the TEN Funding Program. A seasoned veteran, he has presided over 10,000+ pitches in various forums, indicative of his vast influence and commitment to entrepreneurial success.

The architect of a remarkable 40X return for the Austin angel network, Hall deftly manages a complex orchestration of funding mechanisms. He has successfully raised over $32 million through accelerators and has judiciously invested $13 million through a university angel network, proving his strategic investment prowess.

Connect with Hall: https://tencapital.group/about-us/

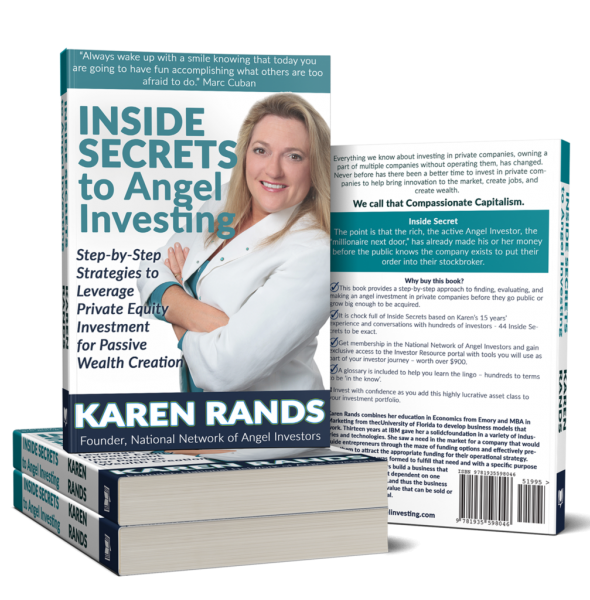

Karen Rands is the leader of the Compassionate Capitalist Movement™ and author of the best selling investment primer: Inside[…]