Our real strength is knowing how investors think and what makes them take action. We will use our deep experience in investor relations to work on your behalf so you can be the ‘rock star’ as you build your business.

Karen Rands

FOR ENTREPRENEURS

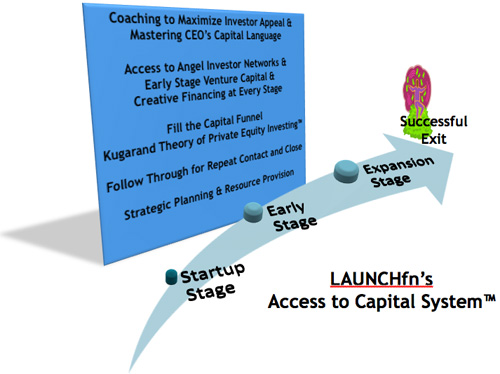

ENTREPRENUER CAPTIAL MASTERY PROGRAM

Programs for Entrepreneur Seeking Capital to Start and Grow

The descriptions offered here are intended to be a guide to the options that are available to the entrepreneurs that recognize they need an experienced expert team to help them solve their cash crunch and growth capital problem. We become an extension of your team so you can focus on what you do best… your business. As we talk through their current capital needs, we will tailor the above program to meet both your funding needs and budget. We charge a fee for our services. We NEVER collect a commission, but we do occasionally defer some of our fees in a shared risk model.

- Our real strength is knowing how the investors think and what makes them take action. We will use our deep experience in investor relations to work on your behalf so you can be the ‘rock star’ as you build your business.Who engages/Kugarand Capital Holdings (LAUNCHfn) for a Capital Strategy and Investor Relations?1. Companies that are in the early stage raising capital only from investors in their state as authorized via intrastate crowdfunding rules.2. Companies that are established with growing revenues but have found through their own efforts that they are too late stage for most angel investor clubs, too slow growth or wrong industry for venture capital firms, and too small for private equity funds, and because of their continued focus on generating revenue, realize they need to outsource their investor relations and capital raise efforts.3. Companies that have over 200 investors from prior capital raises and have the business stage and model appropriate for a Direct Public offering through a REG A+

4. Companies that don’t want to waste time figuring out how to raise capital, the just want to get access to the capital.

5. Companies in a rapid growth pattern that realize that don’t want to give up equity to pay for inventory, equipment or advertising.

If you have an interest in an investor relations campaign, then please schedule an appointment with Karen Rands: Schedule an Appointment (in the comment section indicate you want to talk about an investor relations program)

For Services For Startups, Seed Stage & Pre-Revenue Companies

If you have not yet created a minimum viable product, and have no customers, you are in the most difficult period for raising capital. It can feel very discouraging when you have a passion and a belief that your product or service can make a difference in the world and no one else seems to ‘get it. We can help.

Writing and Preparing your Business Plan

- Evaluating Investor Readiness of Existing Plan

- Develop, Review & Validate Financial Model

- Advise on organizational structure and documentation

- Prepare or update Investor Pitch Deck

- Preparing for pitch competitions

- Coaching on delivering effective investor presentation

- Lean Startup Model

- Validate customer demand

- Prototyping and funding Minimum Viable Product

- Insight on determining market potential

- Biggest concern for investors is getting this right.

- Coaching & Mentoring to remove fear of asking for investment

- Identifying sources of capital

- Strategies to attract different sources of capital

- Maximizing equity value, raising capital for each stage

- Development and Assistance for implementing capital campaign

- Coaching to raise seed capital

- Friends & Family offering, Crowd Funding, Intrastate Capital Raise

- Management of private opportunity pitch event

For Companies wanting to Raise Capital

“From the Crowd”:

With the regulatory changes mandated by the JOBS Act of 2012 and the rules and guidelines issued by the SEC, there are so many ways for companies to raise capital from investors not previously known to them. Entrepreneurs have the ability to reach out to any and all interested parties via just about any means to attract them to their investment opportunity and directly solicit their investment depending on the status of that investor. We offer strategy and investor relations programs for companies seeking to raise capital through: Intrastate Solicitation, Crowd Funding, Reg D 506c and Reg A+. Let us help determine if Crowd Financing is right for you and which program best fits your stage and capital need.

- Identify type of crowd funding campaign, or combination that will work

- Developing campaign strategy and time line

- Evaluating Investor Readiness of Existing Plan

- Help to prepare all the documents needed to market to investors

- Prepare or update Investor Pitch Deck, opportunity video

- Managing the process from out-reach to follow up.

- Lean Startup Model

- Validate customer demand

- Prototyping and funding Minimum Viable Product

- Insight on determining market potential

- Biggest concern for investors is getting this right.

- Coaching & Mentoring to remove fear of asking for investment

- Identifying sources of capital

- Strategies to attract different sources of capital

- Maximizing equity value, raising capital for each stage

- Development and Assistance for implementing capital campaign

- Coaching to raise seed capital

- Friends & Family offering, Crowd Funding, Intrastate Capital Raise

- Management of private opportunity pitch event

For Companies with 2 years of Revenues and are Cash Flow positive, raising $2 Million or More:

Congratulations! You have reached a milestone that many companies never get to. You have probably been working hard and steady, investing every dollar back into your business. You may have realized that you could grow faster and bigger if you had extra money to invest in your infrastructure, sales team, or bring a new product to market. The idea of giving up equity after all your hard work may seem scary, and worse, you really don’t have time to mess with it. We have the solution for you. Because of our vast network of many different types of capital, we can put together a strategy that may use crowd funding, or direct to specific types of investors, or may utilize other alternative financing programs you are not even aware of that combined can meet your specific needs.

- Based on specific factors, recommend offering structure

- Work with professional team to prepare docs and filings

- Develop investor marketing campaign

- Manage due diligence site and investor follow up

- Provide Administrative support for REG D 506c, REG A+, Intrastate General Solicitation

- Collaborate with legal and financial professionals to get business ready for funding

- Evaluate current business and recommend expansion strategy

- Determine financial health of business and value

- Sources of capital appropriate – debt & equity

- Prepare legally, operationally, and psychologically for raising capital

- Prepare business plan, investor pitch deck, one page summary

- Collaborate with legal and financial professionals to get business ready for funding

- 60 days to prep, 6-12 month campaign

- Comprehensive investor relations campaign, with video, social media, press, national interviews

- Engagement of Transfer Agent.

- Accredited Investor Status verified

- Road show for pitching to interested investors

- Secure document management via a secure due diligence site

- Tap in to the vast network NNOAI & LAUNCHfn Investors

- Campaign built to maximize time management C-level executives and minimize disruption of business operations.

For Companies Raising Capital to pay for National Advertising and Media to support a Branding Campaign or National Roll-out:

If you have determined that limiting your marketing strategy to social media and internet advertising isn’t reaching your target as you want and you need to back up your roll out with an advertising campaign to drive customers into a store or to pick up the phone and call, you need to learn about our Media Funding Program. With our strategic partner, we offer a discounted advertising program available on a variety of traditional media from print ads to billboards to television and non-traditional like product placement and digital signage in mass transit and malls. And, even better, part of the cost of the program is paid for on the back end through revenue and/or equity.

- All forms of media advertising available

- Website Banner Adds and Relevant placement

- Print advertising – general to niche magazines, newspaper

- Television & Cable advertisments on 24 hour cycle

- Unique product placements in DIY programs

- Digital and Traditional Billboards

- Advertise to drive customers to website or specific store

- Measurable outcomes

- Can advertise offering bulletin in Financial newspapers

- Grow your brand recognition

- Discounted off of standard rate card for same advertising.

- Portion of the discounted amount is paid up front at time of ad buy

- Remaining portion of the discounted amount is paid through revenue stream

- A line of credit can be given that enhances the balance sheet

- Some very unique ad slots are not available for discount (Super Bowl for example)

- Ad rate is based on a blended 24 hour cycle

- No exclusions, other than specifc smaller regional media

- Excluded media can be purchased at full rate card.

For Companies in High Growth Mode Seeking Short Term Capital:

You may have found yourself in a situation where you finally landed that big client and now you are wondering how you are going to finance the order, buy the inventory, or pay your employees while you wait for the customer to pay. Although we can help with SBA financing, we have many more alternative lenders that we work with that offer a variety of programs to finance a company’s growth. Let us help you navigate the many types of debt available and help you apply to get that funding.

- Alternative Lenders Differ from Banks

- Look at many other forms of assets to secure debt with

- Assets to secure debt with include:

- purchase orders, receivables, cash flow, inventory, and equipment

- offered as direct one to one financing or as revolving line of credit.

- Use debt to finance short term needs

- Less expensive than selling equity to finance growth

- Must plan financial forecast to keep debt in balance

- Investors don’t mind debt as long as their money isn’t going to pay off debt.

- Review your need and potential for different types of debt

- Connect you to the sources of capital

- Manage the communication process and cycle to approval

- Help you forecast how to ease out of the debt by growing revenue.

ENTREPRENUERIAL CAPITAL MASTERY COACHING

You have the power to get the capital you need to start & grow your business. You just need to learn how to harness it and overcome your fear of asking for the money. That is the #1 thing we teach in our coaching program. It is easy to fix your documents or incubate your idea to be investor ready. But if your head isn’t ready, you will subconsciously sabotage your chance of success in raising all the capital you need. Need Seed Capital to Start Your Business? Need Growth Capital? Have you put off raising capital until you feel desperate because you fear the effort and the rejection?

Ever wonder why Investors Don’t seem to “GET” your Deal? Throughout the life of your company, you will need capital to grow. Just like Champion Athletes, An Entrepreneur with Champion Potential needs a Coach. To Run with the Big Dogs, you need to Master the Art of Raising Capital. You need to Know when to Run, Pivot or Shoot! Watch the short video and then Read On below to Find Out How.

Karen Rands

Entrepreneur, Investor, Author, Speaker, Strategic Advisor

Leading the Compassionate Capitalist Movement

Or send Karen an email to

Karen @ kugarandholdings.com and

ask about her speaking topics and radio interviews.